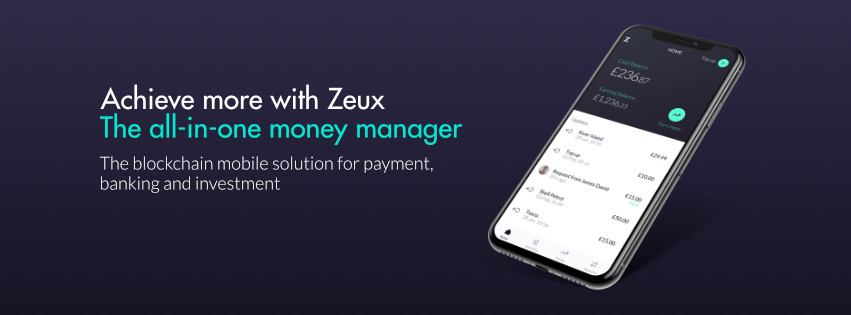

ZEUX Platform is a FCA regulated entity that has launched its items gently and will officially launch the process in the EU next year. Zeux platform aims to deploy services worldwide in 2020. With the help of the ZEUX plan, they will be able to accelerate growth and become the best in class to benefit millions of consumers worldwide. ZEUX transforms existing financial services by creating complex economic management procedures, making it easy, difficult, and reasonable for clients, thus making the service ideal for each.

On the ZEUX program, a client can simply manage the entire their economic portfolios. Entire deals using the ZEUX platform wallets will be performed in an extremely safe environment that meets the highest standards and utilizes the most advanced cyber ecosystem safety protocols. With the help of ZEUX platform, all can be done with just a few clicks.

Economic services Market remain has high potential

Demand.

Economic services play vital parts in individual life and business matters. Wirth developing a worldwide financial system and quick procedures of urbanization, there's a developing demand for financial services such as cell phone payments, simple remittance and access to investment items. Here're some statistics :

Virtual payments.

- Worldwide non-cash deal volumes grew by 11.2 percent in 2015 to 433 USD Billion.

- This development was mainly driven by markets, that recorded a 22 percent boosts in 2015, while mature marketplace grew by 6.9 percent.

- Contact fewer payments are expected to rise to 10 Billion USD in 2018, an 18% boost over 2017.

- The cell phone wallets market is rising steadily, with cell phone proximity payments expected to high 53 Billion USD by 2019

- Debit cards accounted for the extreme share of worldwide non-cash deals, followed by credit cards with 19.6 percent in 2015.

- In stores cell phone payments are predicted to reach 504 Billion ISD by the year 2020, reflecting a compound yearly development rate of 80 percent over 2015 to 2020.

Remittance.

- $537 billion USD was sent as remittances in 16, mostly via firms like Money Gram, Western Union, and RIA.

Investment.

- Worldwide asset under management among planets biggest 500 finds houses have the exceeded 80 Trillion USD.

- PWC expects worldwide assets under management to increase to 146 Trillion USD by 2025.

Crypto Investment

- In 2017, initial coin offerings raised over 7 Billion USD, and 2018 YTD followed pace at over 12 Billion USD

- To capitalize on what'd be a huge option, over 3 hundred digital asset funds have shaped to invest in tokens and money. The asset held by these assets is among 8-10 billion USD, and about 2.5-3 Billion ISD is also exposed to digital money via conventional vehicles like trusts, ETNs and future products. The economic sector is looking to develop tokens into an asset class, that'd place the present nascent 300 billion USD of market cap as part of the ten trillion in worldwide alternative investments, and eventually as the role of the 500 Trillion USD representing entire

securities and assets.

Security and Technology

Individual Data Encryption.

- Encrypted individual data for KYC procedure stored in individual Data Vault.

- KYC verification record stored in the block applying hash.

- Private solution stored in customers’ cell phone and controlled by clients.

Bank Level Security.

- ZEUX tech team has wide industry experience in ecosystem security within economic services and in-core knowledge in the block.

- ZEUX uses multi-layered high-tech security measures to make sure the security and safety of its ecosystem.

Compliance and Regulation.

- PSD2, also recognized as unwrap Banking underpins ZEUX’s main offerings.

- It gives a regulated system from that we can get client data to procedure financial services.

- The features eventually make it simple and more suitable to initiate payments and decrease the delays for their clients.

For further info :

Website: https://www.zeux.tech/

Whitepaper: https://www.zeux.tech/assets/PDF/ZEUX-White-paper-Eng.pdf

Reddit: https://www.reddit.com/user/ZeuxApp

Facebook: https://www.facebook.com/ZeuxApp/

Twitter: https://twitter.com/ZeuxApp

Telegram: https://t.me/zeuxapp

Name : Rifai245

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=2507650

Virtual payments.

- Worldwide non-cash deal volumes grew by 11.2 percent in 2015 to 433 USD Billion.

- This development was mainly driven by markets, that recorded a 22 percent boosts in 2015, while mature marketplace grew by 6.9 percent.

- Contact fewer payments are expected to rise to 10 Billion USD in 2018, an 18% boost over 2017.

- The cell phone wallets market is rising steadily, with cell phone proximity payments expected to high 53 Billion USD by 2019

- Debit cards accounted for the extreme share of worldwide non-cash deals, followed by credit cards with 19.6 percent in 2015.

- In stores cell phone payments are predicted to reach 504 Billion ISD by the year 2020, reflecting a compound yearly development rate of 80 percent over 2015 to 2020.

Remittance.

- $537 billion USD was sent as remittances in 16, mostly via firms like Money Gram, Western Union, and RIA.

Investment.

- Worldwide asset under management among planets biggest 500 finds houses have the exceeded 80 Trillion USD.

- PWC expects worldwide assets under management to increase to 146 Trillion USD by 2025.

Crypto Investment

- In 2017, initial coin offerings raised over 7 Billion USD, and 2018 YTD followed pace at over 12 Billion USD

- To capitalize on what'd be a huge option, over 3 hundred digital asset funds have shaped to invest in tokens and money. The asset held by these assets is among 8-10 billion USD, and about 2.5-3 Billion ISD is also exposed to digital money via conventional vehicles like trusts, ETNs and future products. The economic sector is looking to develop tokens into an asset class, that'd place the present nascent 300 billion USD of market cap as part of the ten trillion in worldwide alternative investments, and eventually as the role of the 500 Trillion USD representing entire

securities and assets.

Security and Technology

Individual Data Encryption.

- Encrypted individual data for KYC procedure stored in individual Data Vault.

- KYC verification record stored in the block applying hash.

- Private solution stored in customers’ cell phone and controlled by clients.

Bank Level Security.

- ZEUX tech team has wide industry experience in ecosystem security within economic services and in-core knowledge in the block.

- ZEUX uses multi-layered high-tech security measures to make sure the security and safety of its ecosystem.

Compliance and Regulation.

- PSD2, also recognized as unwrap Banking underpins ZEUX’s main offerings.

- It gives a regulated system from that we can get client data to procedure financial services.

- The features eventually make it simple and more suitable to initiate payments and decrease the delays for their clients.

For further info :

Website: https://www.zeux.tech/

Whitepaper: https://www.zeux.tech/assets/PDF/ZEUX-White-paper-Eng.pdf

Reddit: https://www.reddit.com/user/ZeuxApp

Facebook: https://www.facebook.com/ZeuxApp/

Twitter: https://twitter.com/ZeuxApp

Telegram: https://t.me/zeuxapp

Name : Rifai245

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=2507650

Tidak ada komentar:

Posting Komentar